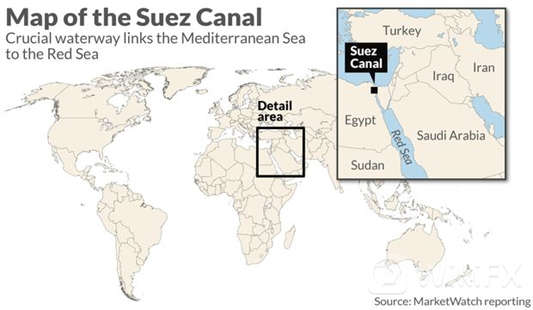

Oil prices rebounded on Wednesday, despite the announcement of a new increase in weekly U.S. oil inventories. For the week ended March 19, these inventories rose by 1.9 million barrels. Prices recovered after news that a container ship ran aground in the Suez Canal, blocking traffic on one of the world's busiest maritime trade routes, especially for oil tankers.

Around 16H10 GMT the U.S. barrel of WTI for the month of May gained 5.12% from the previous day's close to 60.72 dollars. The barrel of Brent North Sea for delivery in the same month was at the same time 63.89 dollars in London, up 5.10%.

Oil prices had lost 6% on Tuesday, after falling more than 6% last week, their biggest weekly decline since October 2020. After surging more than 30% since the beginning of the year, crude prices have begun a correction in recent weeks amid concerns about the third wave of coronavirus in Europe.

The intensification of restrictive measures against the pandemic, particularly in Germany and France, has raised fears of a slowdown in economic recovery, which is weighing on oil demand. In Germany, the Ifo institute has revised its growth forecast downwards on Wednesday to 3,7% in 2021 against +4,2% previously.

Investors today “are trying to gauge how long the massive container ship will block one of the world's busiest waterways,” said Edward Moya, an analyst at Oanda; to gauge the extent of the disruption to black gold supply as a result.

It was the Ever Given, a 400-meter-long ship flying the Panamanian flag and heading from Yantian (China) to Rotterdam, which ran aground on Tuesday across the canal.

(Chart Source: Tradingview 24.03.2021)

With traffic expected to resume “later today or Thursday,” crude prices are “settling in at their highs” in late European trading, Moya noted.

Disclaimer: This material has been created for information purposes only. All views expressed in this document are my own and do not necessarily represent the opinions of any entity.