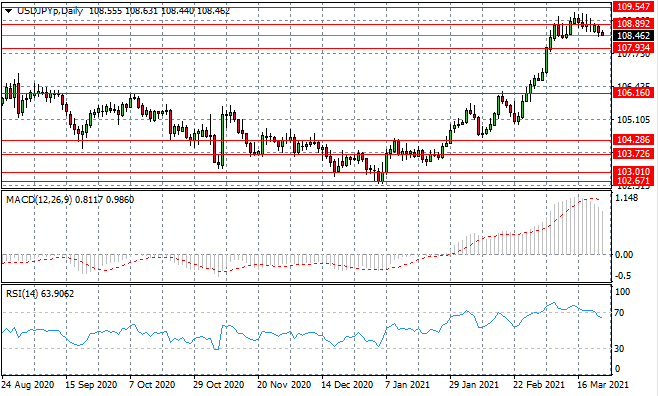

USD/JPY

The USD/JPY pair has finally broken the 108.89 price level and is fading towards the 107.93 support area. Currently, bearish momentum remain weak and therefore a complete reversal of the rally appears unlikely. Momentum indicators are beginning downward trajectories.

USD/JPY货币对终于成功突破108.89价位,但随后逐渐向107.93支撑区移动。目前看跌势头仍然疲弱,因此反弹行情完全逆转的可能性似乎不大。动量指标开始下降。

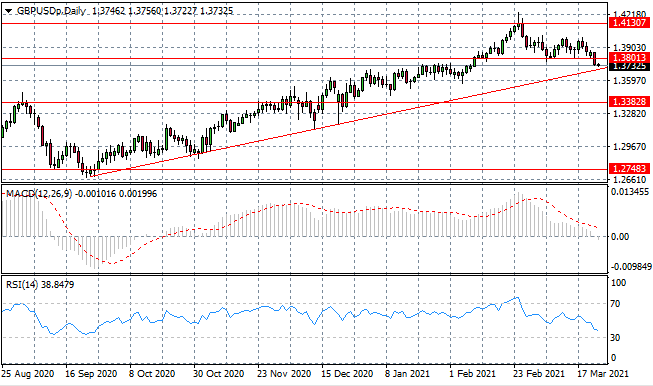

GBP/USD

The GBPUSD pair ha pulled back to the ascending trendline after a break of the 1.380 support level. The spike in selling activity may be short-lived, however, as typically price action turns bullish after testing the trendline. Momentum indicators have downward trajectories.

GBP/USD突破1.380支撑位后回调至上升趋势线。抛售的激增可能较为短暂,但是通常价格走势在测试趋势线后会转为看涨。动量指标有下降的轨迹。

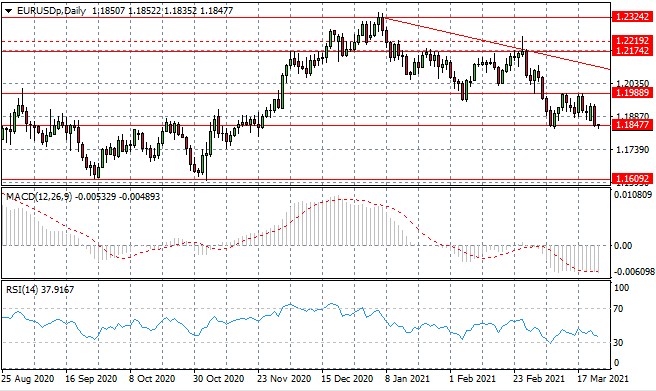

EURUSD

The Eurodollar has moved to test the 1.184 price level once again, as a range has formed between the 1.184 and 1.198 price levels. A break would indicate a total price reversal, essentially undoing gains made since the Covid-19 outbreak. Momentum indicators remain in bearish territory.

随着1.184至1.198价格区间的形成,Eurodolla再次测试1.184价位。若跌破将表明价格走势的整体逆转,将基本上抵消自新冠疫情爆发以来的涨幅。动量指标仍处于看跌区域。

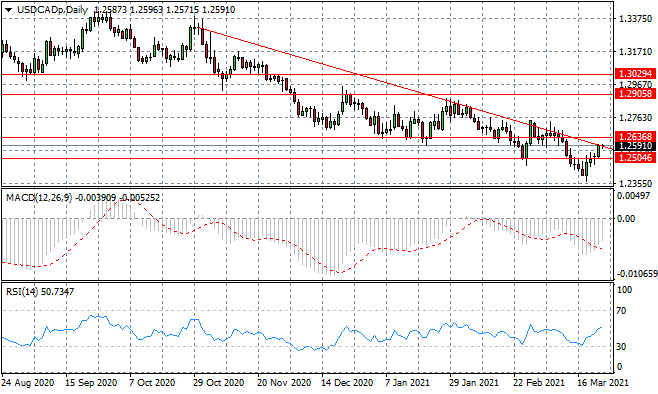

USDCAD

The USDCAD is testing the ascending trendline line which has been acting as a strong resistance area for the pair, containing rallies. Considering the fact that the pair is an established petrocurrency, we may expect weakness as economic conditions continue improve. Momentum indicators have upward trajectories.

USD/CAD正测试上升趋势线,该趋势线仍为遏制反弹的强阻力区。鉴于该货币为公认的石油货币,随着经济状况的持续改善预计将走弱。动量指标有上升的轨迹。

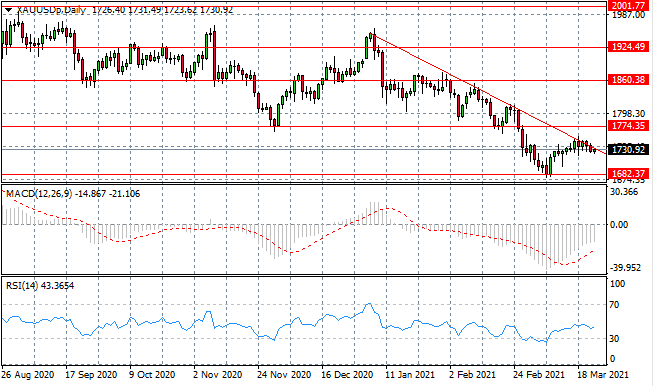

XAUUSD

XAUUSD is testing the descending trendline which has been established as a strong resistance area for the pair. Neither buyers nor sellers are dominating price action and the pair may hug the trendline going forward. Momentum indicators have flattened in bearish territory.

XAU/USD正测试下降趋势线,该趋势线已被确定为强阻力区。鉴于买卖双方均未主导价格走势,接下来该货币对可能会紧随趋势线。动量指标在看跌区域持平。

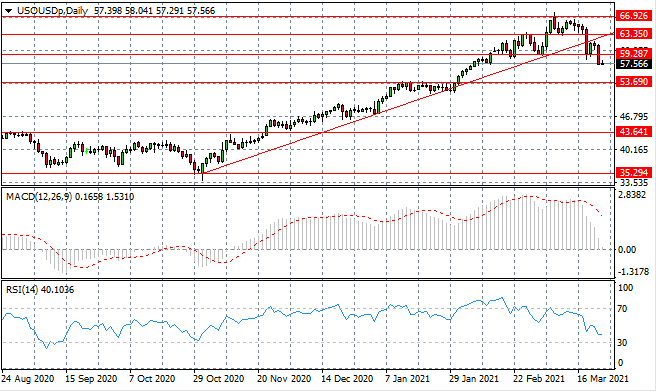

USOUSD

The USOUSD has broken the 59.28 support level as well as the descending trendline. The next target is the 53.69 support level as the commodity struggles to sustain the stabilizing price of $60 per barrel. Momentum indicators have sharp downward trajectories.

USO/USD已突破59.28支撑位以及下降趋势线。下一个目标为53.69支撑位,大宗商品难以维持每桶60美元的稳定价格。动量指标有急剧下降的轨迹。

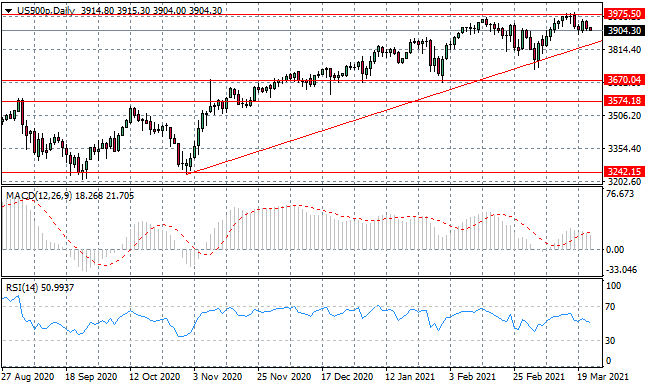

US500

US500 oscillations are beginning to narrow indicating that a potential breakout is on the cards. The index is moving closer to the apex of an ascending triangle which is typically a bullish continuation pattern. Momentum indicators are languishing in bullish/neutral territory.

US500震幅开始收窄表明可能即将出现突破。该指数正在接近通常为看涨延续形态的上升三角形的顶点。动量指标在看涨/中立区域走弱。

In the event of any discrepancies between the Chinese version and English version of the Daily Insights, the latter shall prevail.

以上文章中英文版本若有任何歧义,概以英文版本为准。

This article is to be used only as a reference, not as a basis for trading.

策略仅供参考 不做交易依据